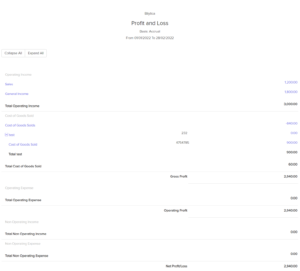

Profit and Loss #

This report provides a thorough summary of all of your business’s profits and losses over a specified period of time. It also includes a breakdown of your operational and non-operating costs.

To view this report:

- Go to Reports > Profit and Loss.

Let us take a look at the different sections that this report contains:

Operating Income

Money that you’ve received from all of your clients and your company’s sales transactions.

Cost of Goods Sold

All costs are associated with purchasing or producing the things that you sell to your customers.

Operating Expense

These are the costs incurred by your company. If you choose an Expense account to track your spending while recording them, it will appear here.

Advertising & Marketing, Meals and Entertainment, Automobile Expense, and Lodging are some of the expense accounts available in Erpisto.

Non-Operating Income/Expense

These are income or expenses incurred by an organization’s activities that are not related to its business operations.

Consider the dividends a company has received. A loss in a currency exchange would also be considered a non-operating expense.

Note:

- You can click any account in the report to view its drill-down summary.

- All the values are generated based on the time period that you’ve set.

To customize this report:

- Go to Reports > Profit and Loss.

- Click Customize Report at the top of the page.

![]()

You can customize the report based on the following filters:

| Filters | Description |

|---|---|

| Date Options | Select the time period for which you want to generate the report. This can be for a current or previous period/year. You can even set a custom time period of your own. |

| Report Basis | Accrual: Values are generated when the transactions are created. Cash: Values are generated when they receive the cash. |

| Year To Date | Compare this report with the report generated from the beginning of the financial year to this date. |

| Reporting Tags | Filter your reports based on the reporting tags that you have created. |

- Click Run Report.

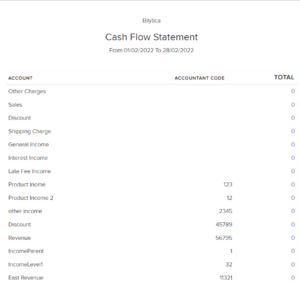

Cash Flow Statement #

This report shows how much money is flowing in and out of your organization from various sources such as operations, investments, and finance.

To view this report:

- Go to Reports > Cash Flow Statement.

Let us take a look at the different sections that this report contains:

Cash Flow from Operating Activities

Operating activities are the business activities that an organization engages in. Accounts such as Net Income, Accounts Receivable, and Inventory Asset is used to track the money that comes in from such activities.

Click any of the sub-fields to view a drill-down of any account.

Cash Flow from Investing Activities

As a business, you’d want to invest in a variety of assets to ensure that it runs smoothly. The cash flow generated by such activities will be shown here.

For example, buying stationery, furniture for a new branch of your office.

Cash Flow from Financing Activities

In Erpisto, you can record such transactions in the Banking module under a bank.

Net Change in cash

Sum of the cash flow from operating, investing, and financing activities.

Note:

You can click on any account to view its drill-down summary.

To customize this report:

- Go to Reports > Cash Flow Statement.

- Click Customize Report at the top of the page.

![]()

You can customize the report based on the following filters:

| Filters | Description |

|---|---|

| Date Options | Select the time period for which you want to generate the report. This can be for a current or previous period/year. You can even set a custom time period of your own. |

| Year To Date | Compare this report with the report generated from the beginning of the financial year to this date. |

| Reporting Tags | Filter your reports based on the reporting tags that you have created. |

- Click Run Report.

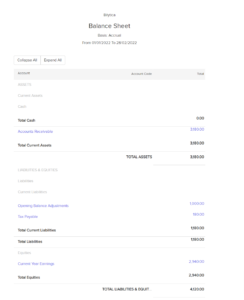

Balance Sheet #

The balance sheet is a document that describes the amount of money in all of your company’s accounts under several categories such as assets, liabilities, and equity.

To view this report:

- Go to Reports > Balance Sheet.

Let us take a look at the different accounts that this report contains:

Assets

Value of all the assets in your organization. Some of the asset accounts in Erpisto include:

- Current Assets

- Cash

- Other Current Assets

Liabilities & Equities

All the liabilities and equities that are recorded in your organization. Some of these accounts include:

- Current Liabilities

- Equities

Note:

You can click on any account to view its drill-down summary.

To customize this report:

- Go to Reports > Balance Sheet.

- Click Customize Report at the top of the page.

![]()

You can customize the report based on the following filters:

| Filters | Description |

|---|---|

| Date Options | Generate a report forever month year and other time intervals or set a custom time period of your own. |

| Report Basis | Accrual: Values are generated when the transactions are created. Cash: Values are generated when they receive the cash. |

| Reporting Tags | Filter your reports based on the reporting tags that you have created. |

- Click Run Report.