What are Sub-Accounts? #

Child accounts formed under a parent account are known as sub-accounts. It makes it easier to keep track of the parent account’s revenue and expenses.

When do I use Sub-Accounts? #

Let’s imagine you want to keep track of all your travel expenses, so you open a Travel Expense account. You can construct sub-accounts such as Lodging, Tickets, and Cab Charges under the parent account. The creation of sub-accounts also allows you to drill down into specific Reports for more information.

A few other scenarios where sub-accounts are helpful for precisely tracking revenue or spending are discussed below.

Scenario 1 #

You keep track of all the Insurance you pay in an expense account. You want to keep track of all of your insurance payments separately. As Insurance, you can create an Expense account. To track the amount paid for each Insurance, you can create sub-accounts under the parent account such as Property Insurance, Automobile Insurance, Other Insurances, and so on.

Scenario 2 #

You own a company, and there are various ways to make money. You can construct sub-accounts such as Sales Revenue, and Interest Received, Rentals Received, Other Income, and so on under the Income account. Under Rentals Received, you can create a sub-account for Beach View Property, Housing Flats, and so on. This allows you to keep track of your earnings in great detail.

Create Sub-Accounts #

Sub-accounts can be created under a parent account using either the Chart of Accounts or other Erpisto modules.

To create a sub-account from Chart of Accounts, please follow the steps mentioned below:

- Navigate to the Accountant module on the sidebar and click on New Account.

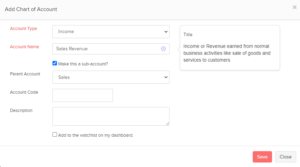

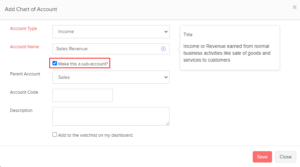

- A pop-up page is displayed. Select the appropriate Account Type and give an Account Name.

- Check the Make this a sub-account option.

- Choose a suitable Parent Account and fill in the other details.

- Don’t forget to hit Save.

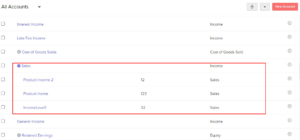

The newly formed sub-accounts will be listed under the parent account in the Chart of Accounts.

Note: Under a sub-account, you can only create five sub-accounts. A parent account, on the other hand, can have several sub-accounts.

Currently, you can create sub-accounts under all the following Account Types,

- Other Asset

- Other Current Asset

- Cash

- Fixed Asset

- Stock

- Other Current Liability

- Long Term Liability

- Other Liability

- Equity

- Income

- Other Income

- Expense

- Cost of Goods Sold

- Other Expense

Sub-Accounts in Reports #

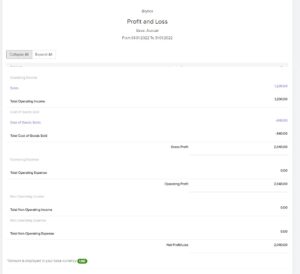

The Profit and Loss Report, Cash Flow Statement, Balance Sheet, Trial Balance, and General Ledger will all reflect the changes in credit and debit of the sub-accounts.

You can view the reports in either a Collapsed or Expanded view in Erpisto. The parent accounts are displayed in the Collapsed view, while the drill-down report and sub-accounts are shown in the Expanded view.

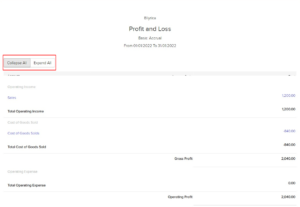

- To view the effect of Sub-Accounts in the Profit and Loss Report, navigate to Reports > Business Overview > Profit and Loss.

To see a drill-down report of the parent account and its sub-accounts, click Expand All.

Click Collapse All to see only the parent accounts.

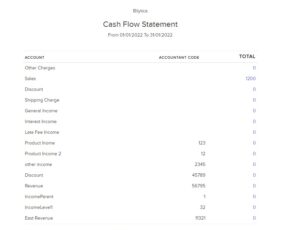

- Navigate to Reports > Business Overview > Cash Flow Statement to see how Sub-Accounts affect the Cash Flow Statement.

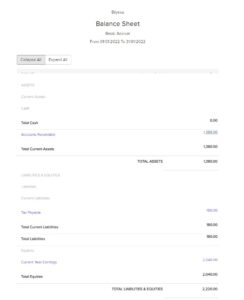

- To view the effect of Sub-Accounts in the Balance Sheet, navigate to Reports > Business Overview > Balance Sheet.

- The changes reflected by sub-accounts in General Ledger can be viewed by navigating to Reports > Accountant > General Ledger.

- Navigate to Reports > Accountant > Trial Balance to see the effect of sub-accounts in the Trial Balance Report.